A COVID response plan for ecommerce leaders

Perhaps the Retail Apocalypse is finally upon us. As the world confronts the millions of confirmed coronavirus cases, ecommerce executives are beginning to confront how they will respond in the second quarter of this year. Now, more than ever, it feels like the state of digital and ecommerce is changing from one day to the next.

Ed Kennedy

As the stock market craters, companies face cash shortages and people start losing their jobs, what was measured optimism in late February seems like foolish naivete as we turn to April. Thankfully, there are a few “new realities” taking shape in these times of uncertainty for ecommerce leaders. Here are three ecommerce strategies to consider in Q2 based on the coronavirus uncertainty.

#1: Adopt a Marketplace Strategy

Marketplaces like Amazon and eBay have seen spikes in traffic and orders as consumers try to meet their basic needs from the comfort of their couch. Consumers have flocked to Amazon for essential goods as retail foot-traffic has dropped by at least nine percent since February. They’ve also faced criticism for not catching price-gauging merchants who sold personal protective equipment (PPE) and other essential items for hundreds of thousands of percentages higher than normal price.

Retailers should consider fast-tracking any initiatives to launch their own marketplaces during the economic downturn. Retailers who have not considered a marketplace strategy should strongly consider piloting a marketplace model, inviting third-party merchants to sell on their platform.

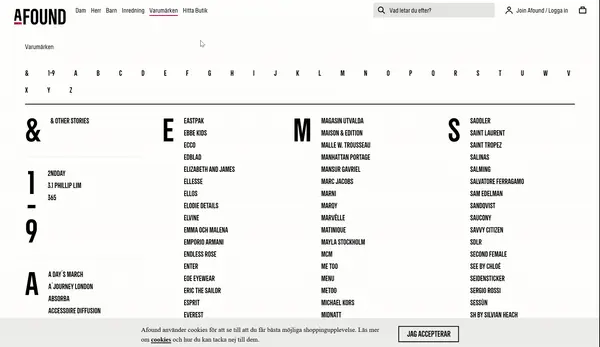

A retailer who is positioned well for this is H&M. One of their retail chains, Afound, has piloted a marketplace strategy using the Episerver platform. On afound.com consumers can browse products sold and fulfilled by Afound while also finding different items sold by brands such as Himla.

Afound sells hundreds of brands from its own warehouse and using third-party marketplace merchants.

Other online-only retailers are responding to the coronavirus by supporting smaller brick-and-mortar retailers. Despite forecasting lower sales and profitability, Zalando in Europe have stepped up to help smaller retailers list their inventory on the Zalando website by waiving its commission fee for all merchants with physical stores who sell on their platform from April 1-May 31.

Brands should consider aligning with large online retailers or marketplaces where consumers will be active over the coming weeks and month. According to Episerver’s Reimagining Commerce report, when consumers have a specific purchase in mind, they go to Amazon or another marketplace first 43 percent of the time; 43 percent of consumers go to Google first; and only 10 percent of consumers go to a retailer or brands website. This trend is sure to continue and expand as consumers seek price, convenience and selection over experience and product information.

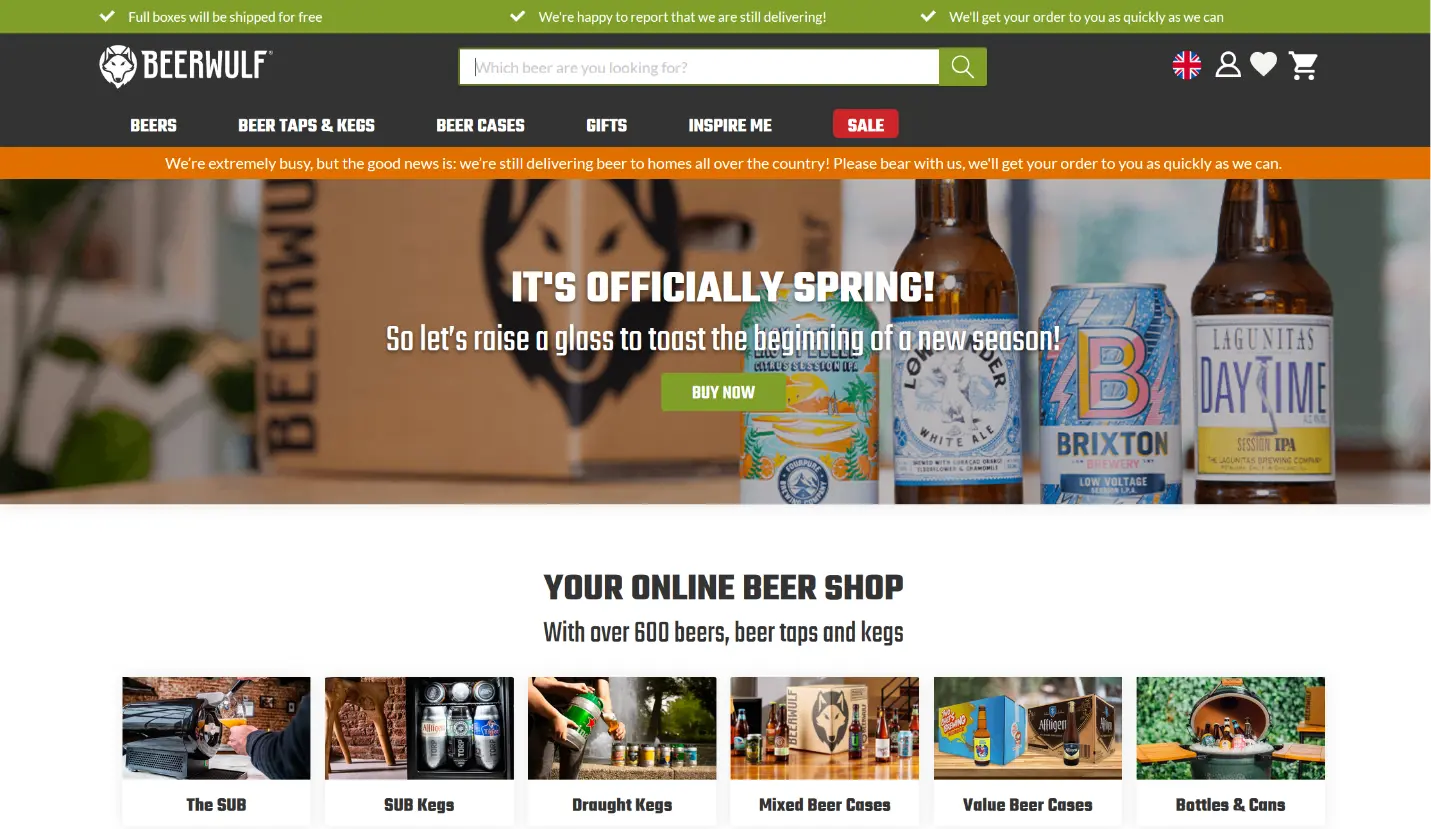

One brand that has took an innovative approach to marketplaces and changing consumer behavior is Heineken. This iconic brand chose to incubate and spin-out an online beer retailers, BeerWulf, on the Episerver platform. This ecommerce site allows consumers in Europe to purchase beer delivery boxes including Heineken microbrews. BeerWulf also taps into smaller microbrew brands to complement its assortments. Additionally, the site sells Heineken’s in-home beer tap and dispensing systems. No coincidence there. This is a very smart move for a brand to create a direct-to-consumer channel it owns while still maintaining corporate distance, so it does not disrupt other distribution channels.

Bottomline: If you’re a retailer, consider launching a marketplace model of your own to compete with Amazon and serve your customer better. If you’re a brand, consider listing on Amazon or other large online-only retailers. If you want to push the envelope, rip a page out of Heineken’s playbook and launch your own direct-to-consumer channel. In short, you need a marketplace strategy.

#2: Fast Track Ecommerce

Ecommerce executives should consider fast-tracking ecommerce investments they have been working on for 2020 and beyond. It is best to scale these initiatives down into very small pilots that help solve customer experience or operational challenges caused by the coronavirus pandemic.

One example is investing in omnichannel fulfillment as part of your ecommerce strategy. As retail foot-traffic sinks and retailers’ inventory sits idle in stores, connecting consumers with local merchandise is a win for businesses to offload inventory and a win for customers who want their deliveries fast.

Retailers large and small including grocery and food service need to innovate and do it now. Large retailers from Best Buy to Dick’s Sporting Goods are converting their stores to curbside pick-up stations in an attempt to serve customers. Fine dining restaurants are launching quick-serve delivery business models or delivering Blue Apron style meal-kits. Episerver customer Buffalo Wild Wings has online ordering and free delivery as part of its ecommerce strategy and to adapt to the times.

Even smaller retailers are innovating. A small retailer in California, Tanaka Farms, closed its walk-in store front and built a drive through grocery store in just two weeks. Associates wearing personal protective equipment walk alongside a customer’s car while they inspect and select grocery items. Another associate completes your purchase using touch-free mobile point of sale terminal.

Retailers in every category need to rethink how they engage and serve consumer needs. Tanaka Farms transformed their grocery store-front into a drive-through grocery store in response to Coronavirus.

So now is the time to fast-track an omnichannel initiative with narrow scope and specific use cases to support consumers who are sheltered-in-place and only go outside to pick up groceries or pick up medical supplies.

Curbside pickup and ship-from-store initiatives are two strong candidates. Curbside pickup allows consumers to purchase ahead of their visit. Upon arrival, an associate delivers the product into the trunk of their car. This often requires significant investment in software, design and associate training.

Ship-from-store is another option where online ecommerce orders are picked and shipped directly from store inventory by associates. This is often easier to achieve for retailers without omnichannel technology built yet. The benefit is your associates become your warehouse staff and stale inventory gets moving faster.

Whether you jump with both feet into omnichannel fulfillment scenarios, the writing is on the wall, everyone needs direct-to-consumer ecommerce. For retailers or brands who have hidden behind “channel conflict” and “business as usual” can use the coronavirus pandemic as political equity to pull of direct-to-consumer transformations.

Some grocery retailers working who leverage the Episerver platform have launched direct-to-consumer ecommerce, at the request of their governments, in just four weeks. It is possible. It takes vision, clear communication and a willingness to cut red-tape to launch your new ecommerce website.

#3: Prepare for Permanent Changes

The coronavirus has the potential to change how we live and work. Will commercial offices become nostalgic relics of the early 2000s? Will a new wave of homeschooling sweep the United States? Regardless, ecommerce executives need to prepare for the new consumer expectations post-coronavirus.

Many retailers and brands have already adapted to changes in customer behavior. LivingSpaces.com, leveraging the Episerver ecommerce platform, now offers free two-day shipping to incentivize online orders during a time when store foot traffic has grinded to a halt.

Consumers are going to expect more transparency and flexibility from companies after the coronavirus pandemic. Consumers will want transparent pricing and purchasing options on your website. Consider the coronavirus pandemic an opportunity to create authentic connections with your customer including candid communication about how your business is supporting customers and what you will be offering them when life returns to normal (if there will be such a thing). If promotions, fee waivers and discounts are likely to go away once you return to normal, retailers should state that clearly upfront.

Direction in Chaos

Chaos creates opportunity if you’re willing to see it that way. Chaos also exposes weak points and galvanizes teams to work creatively to solve problems. Challenges that were previously seen as roadblocks in an ecommerce strategy are washed away by the need for change. People who resisted your ideas are now ready to make changes to keep the company (and their careers) afloat.

Necessity is the mother of invention. Retailers and brands need to re-invent themselves, now.

A look at how this looks for B2B brands…

What is undeniable is the underlying shift to ecommerce is well underway. Forty-one percent of B2B marketers and technology executives agreed that selling direct to customers online was a significant opportunity for their business in 2020. In fact, 72 percent of B2B executives state that they expect over 40 percent of their total company revenue to be derived from websites they own and operate. This is according to Episerver’s March 2020 survey of 600 global B2B leaders.

According to this research conducted by Episerver (the full report will be out over the next two weeks), 52 percent of B2B executives said they were losing revenue to Amazon. What’s interesting is that an equal 52 percent of executives said that Amazon is an opportunity. What remains is the need to be relevant to what customers need during these unprecedented times.