RESOURCES and content

Stay informed, get inspired

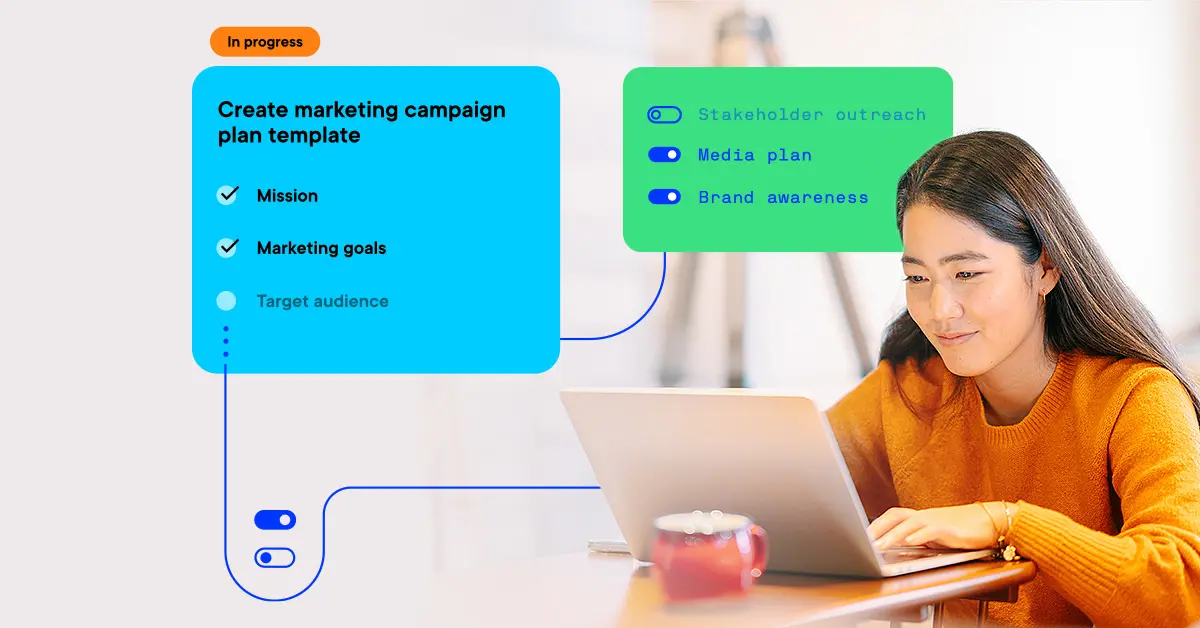

Product experimentation guide

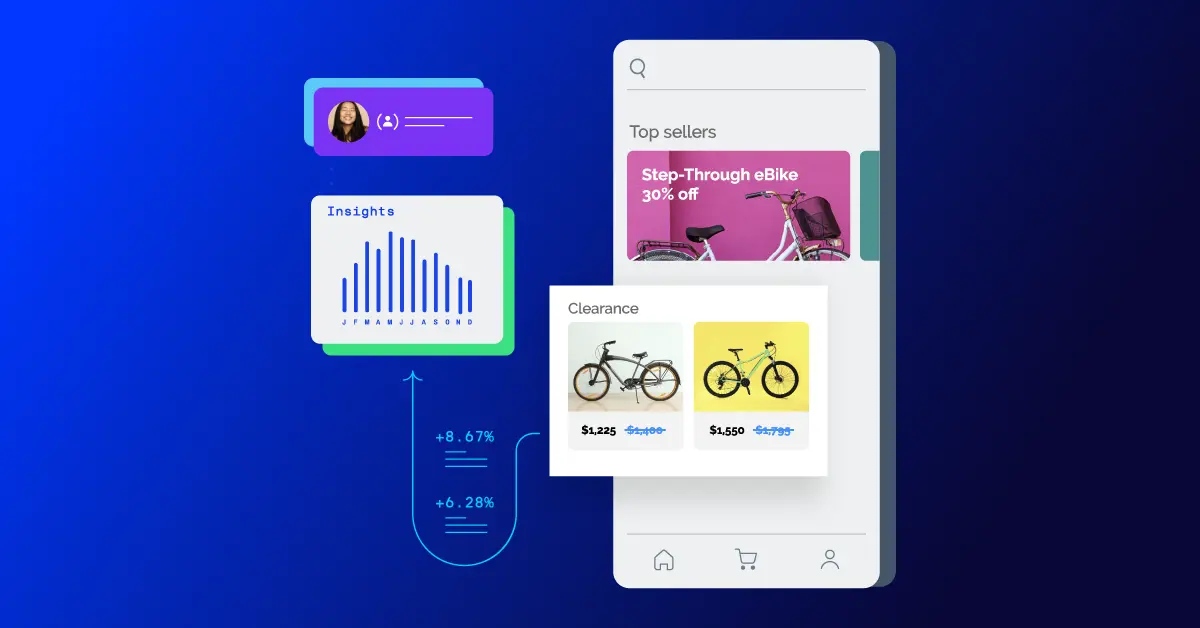

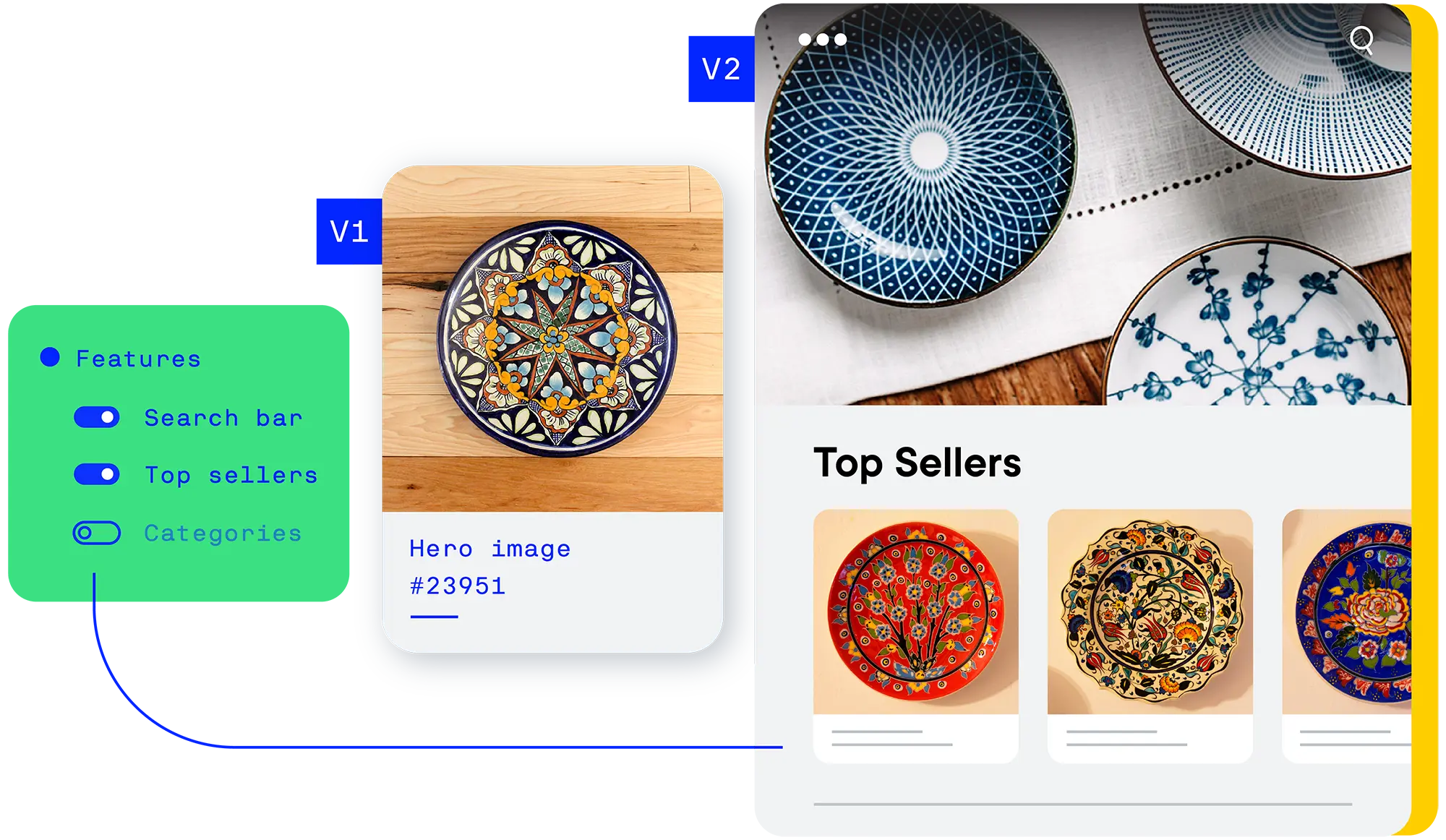

Ship features faster

This guide breaks down the entire product development process: how to identify and prove the best ideas, prioritize key features, and deliver without risks.

Learn everything you need to know about introducing experimentation early and how to do it the right way for your team.

Latest

Discover morePicked just for you

See all articlesTest your knowledge

Crafting exceptional customer experiences

See all customer storiesThe power of experimentation

The Salesforce team is running more tests than ever before thanks to Optimizely. Learn how they're going beyond simple AB tests to answer more complex questions.

The best of Opticon 2023

Unlock all sessionsSeize the Moment: The Opportunity for Digital Leaders

Informative, empowering, cutting-edge content from our Executive Leadership team and customers including Zoom, Tapestry and Schwab. Unlock all sessions